7 Simple Techniques For Transaction Advisory Services

Wiki Article

The Facts About Transaction Advisory Services Uncovered

Table of ContentsExamine This Report about Transaction Advisory ServicesThe Best Guide To Transaction Advisory ServicesNot known Factual Statements About Transaction Advisory Services

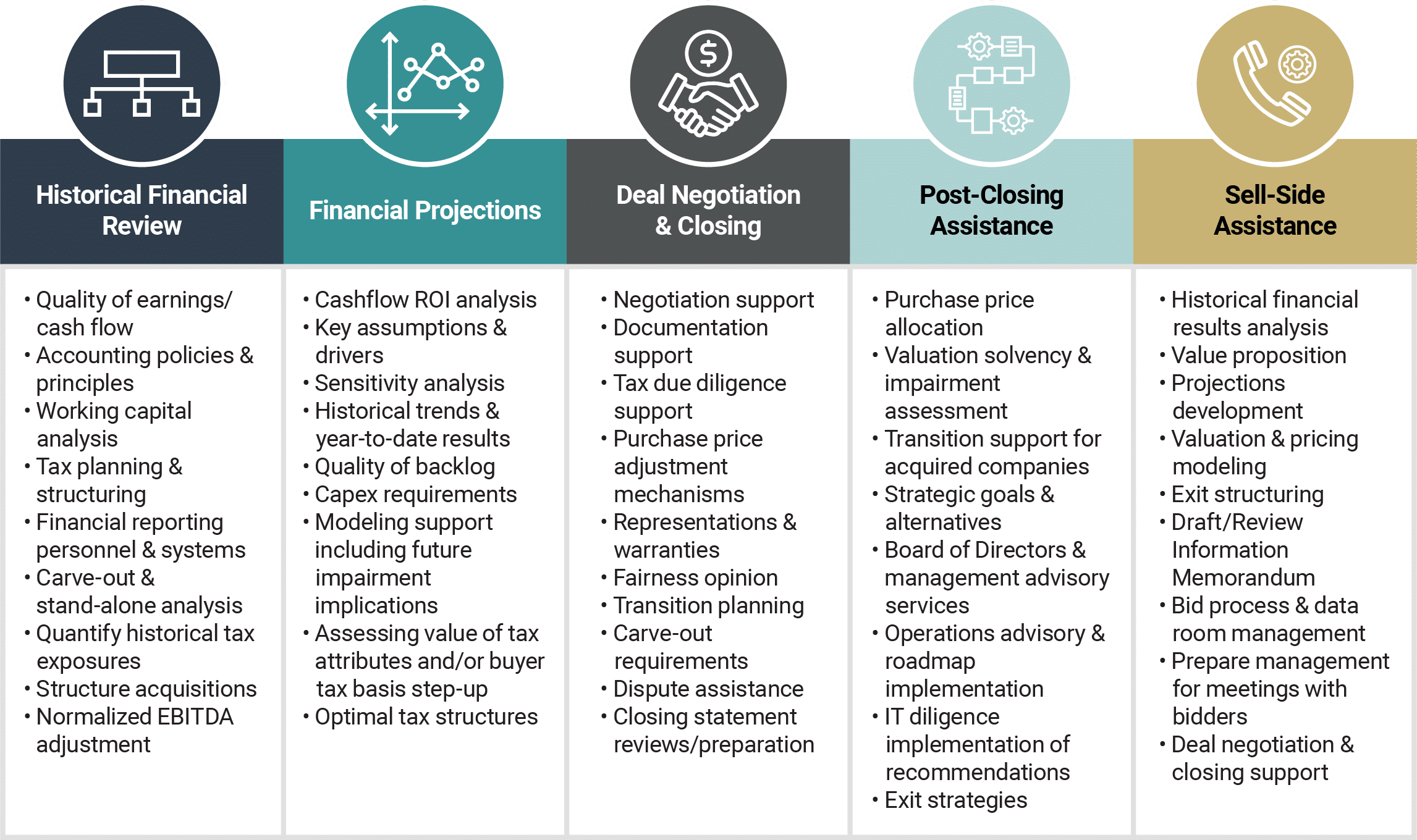

A career in Transaction Advisory Services is an exciting and competitive areas within finance and consulting. Transaction advisors advise clients on major corporate transactions during major corporate events. Success in this field demands technical ability and business acumen, and it offers a front-row seat to transformative business decisions. If you’re considering a career in TAS, the path may seem intimidating at first. Breaking in requires preparation, skill development, and persistence. It is very achievable with careful planning and the right preparation.

Education is often the primary requirement that firms use when screening applicants. Most TAS professionals hold a bachelor’s degree in accounting, finance, business administration, or economics. If you are still in college, seek out coursework that mimics real-world deal-making situations. Extracurricular activities like business competitions are valuable opportunities to gain exposure to real-world problems - Transaction Advisory Services. For those who are coming from another field, consider pursuing designations valued in finance and advisory work

Many people start in audit or consulting before moving into TAS. Public accounting experience is highly regarded. Other candidates enter TAS from investment banking, corporate finance, or management consulting. If you’re early in your career, internships can be a valuable entry point. Even if you start in a different department, let your managers know you want exposure to deals.

The Best Guide To Transaction Advisory Services

Technical skills can make you more marketable. You’ll need to be proficient in Excel modeling, scenario web analysis, and transaction structuring. Online courses are a great way to sharpen your skills.TAS is a client-facing business, meaning you’ll spend time explaining findings. Employers look for candidates with a professional presence. Practice turning complex financial data into clear narratives. Transaction Advisory Services. Public speaking, writing workshops, and group projects can build confidence

Networking is often the deciding factor in breaking into TAS. Attend industry conferences, join finance and M&A groups, and reach out to TAS professionals.

Get This Report about Transaction Advisory Services

Your resume should show measurable results. Your cover letter should connect your experience to the job.

TAS interviews combine technical and behavioral questions. Prepare for case studies. Practice using the structured answers for behavioral questions.

Read Wall Street Journal, check this Financial Times, and M&A publications to discuss deals intelligently. The path to TAS can be long, but persistence pays off. Start in a smaller market or related role. Breaking into TAS is absolutely possible with the right approach. Commit to directory continuous learning and skill-building and you’ll stand out.

Report this wiki page